|

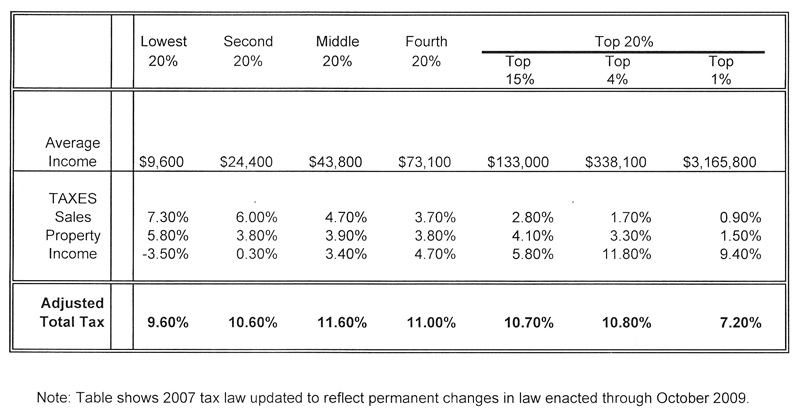

In the current debate on New York state taxes, the elephant in the room is fairness. Are we treating retired property taxpayers fairly? Are school taxes too high on Long Island compared with the rest of the state? Are millionaires and corporations paying their fair share? Are millionaires’ concerns more important than our children’s education? In most cases, the debate centers on egregious examples. For instance, in Buffalo, a millionaire lawyer buys a million dollar condominium but pays no property taxes because of an Empire Zone Tax Credit, a savings worth $260,000 over the 10 years of the credit. At the same time, just blocks away, a middle-class family must pay full taxes on a $60,000 home. The builders of the project supported the tax break, saying, “It was the only way the project made economic sense.” But what does this say about the fairness of the system as a whole and how it should be changed? One dictionary definition of fairness states: free from favoritism, self-interest or preference in judgment. This is the common sense definition that most of us have in our heads when we talk about taxes. Tax theorists have long tried to deal with the many concepts of tax fairness. Is horizontal theory (treating individuals in the same category) or vertical theory (treating individuals in different categories) more important? How do we treat intergenerational tax burdens? Should we look at taxes for an individual in a single year or over a lifetime? What about regional differences? Should we make allowances for high-cost areas? In each case, a good argument for using one category over the other to talk about tax fairness is possible. In each case, one group of New York state residents will be helped and another hurt. One way philosophers get around these problems is to use what they call the “veil of ignorance.” In other words, if you were unaware of your economic status, what type of tax system would you choose? This is the reasoning behind conservative Chicago professors Blum and Kalven in their book, The Uneasy Case for Progressive Taxation. They argue the value of progressive taxes based on “distributive justice.” Put simply, the authors argue that people who make more money, have a greater ability to pay and who benefit the most from government should pay more taxes. For Blum, Kalven and most of their readers in 1952, this was obvious. Today, the rich try to confuse the argument of justice and turn to efficiency as the measure as if more goods for fewer people is a just outcome for society. So, if a progressive tax system at some level is important to having a fair tax system, how does New York stack up? Even with the current millionaire’s tax in place, the Institute on Taxation and Economic Policy calculates the top 1 percent of New York State taxpayers pay 4.4 percent less as an effective tax rate than the middle 20 percent of New Yorkers. In fact, the top 20 percent pay a lower rate on their income than the lowest 20 percent, who make less than $16,000 per year. The table below shows the entire distribution. How many New Yorkers understand that we have a regressive system that taxes the poor more than the rich? Would knowing this change the public debate? UUPers are members of the working class, and the working class deserves to be treated fairly. It is our job to ask these tough questions and to bring the taxation discussion back to the issue of justice. New York State and Local Taxes in 2007 |

Warning: count(): Parameter must be an array or an object that implements Countable in /home/uuphos5/public_html/voicearchive/wp-includes/class-wp-comment-query.php on line 405